(New Delhi/Washington, August 1, 2025) – US President Donald Trump’s abrupt imposition of 25% tariffs on all Indian goods, coupled with an unspecified “penalty” over New Delhi’s energy ties with Russia and BRICS alignment, has triggered market turmoil, sector-wide panic, and a diplomatic crisis between the world’s largest democracies.

Effective today, the measures threaten to derail India’s manufacturing ambitions, shrink its GDP growth by up to 0.4%, and fundamentally recalibrate a strategic partnership once touted as pivotal to countering China .

The Tariff Bomb: Higher, Harder, and With a Vengeance

Trump’s Truth Social announcement blindsided Indian negotiators who believed a deal was imminent after months of talks. Beyond the 25% baseline tariff—significantly higher than rates imposed on allies like Japan and the EU (15%) or Vietnam (20%)—Trump declared India would face an additional penalty for being “Russia’s largest buyer of ENERGY, along with China” and for purchasing Russian arms “at a time when everyone wants Russia to STOP THE KILLING IN UKRAINE” .

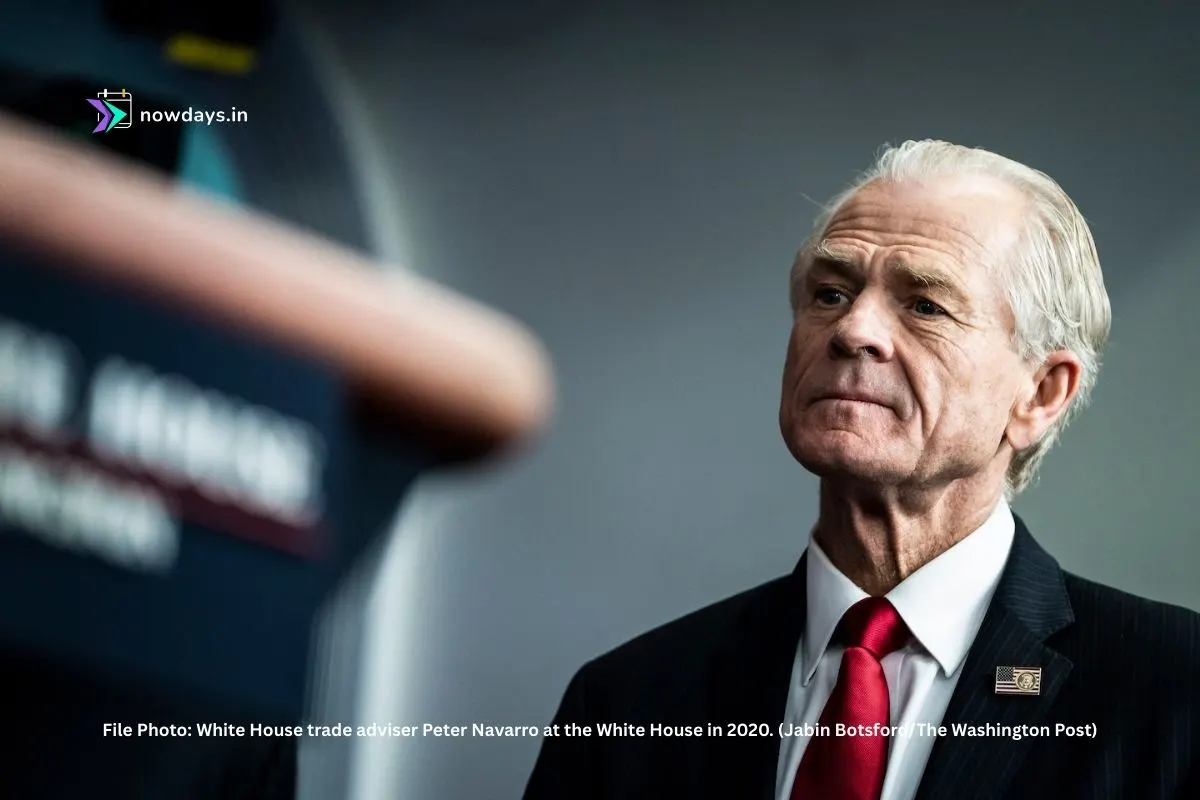

White House Economic Adviser Kevin Hassett later explicitly linked the penalty to India’s participation in the BRICS bloc, which Trump has labeled “anti-American” for challenging dollar dominance .

- Deadline Whiplash: Despite the definitive announcement, Trump later claimed negotiations were ongoing: “They’re willing to cut [tariffs] very substantially. But we’ll see what happens… You’ll know by the end of this week” . This leaves exporters in limbo, with US buyers already canceling or freezing orders .

- The “Penalty” Sword of Damocles: The unspecified nature of the penalty—whether financial sanctions, higher sectoral duties, or restrictions on services trade—has paralyzed businesses. “Everyone is talking about 25%… We don’t know what is going to be added as penalty for importing oil from Russia,” warned investor D Muthukrishnan .

Economic Fallout: Growth, Jobs, and Ambitions at Risk

Financial markets reacted instantly: the rupee plunged to a five-month low, the Sensex dropped nearly 800 points, and bond yields spiked . Economists warn the tariffs could shave 0.2%-0.4% off India’s GDP growth this fiscal year . The pain will be acutely felt in key export sectors:

- Gems & Jewellery ($10B Exports): The Gem and Jewellery Export Promotion Council called the tariffs a “deeply concerning development” threatening thousands of jobs. A blanket 25% duty will “inflate costs, delay shipments, distort pricing, and place immense pressure on every part of the value chain” .

- Textiles & Apparel: Major suppliers to US retailers like Walmart and Gap face obliteration. “It will seriously test the resolve… as we will not enjoy a significant duty differential advantage” against Vietnam, stated the Confederation of Indian Textile Industry. Companies like Vardhman Textiles and Welspun Living reported US orders drying up pre-emptively .

- Pharmaceuticals ($8B Generics Exports): While Indian pharma giants (Sun Pharma, Dr. Reddy’s) derive >30% revenue from the US, industry experts warn US healthcare could suffer more. Indian generics saved the US system $220 billion in 2022 alone—costs likely to surge for American patients if tariffs hold .

- Electronics & Apple’s India Bet: India recently overtook China as the top smartphone source for the US, driven by Apple’s shift of iPhone production. Analysts warn a 25% tariff could “meaningfully set back” this strategy, forcing Apple to absorb costs or reconsider sourcing. Foxconn exported $3.2B worth of iPhones from India to the US in Q2 alone .

- Refiners & Russian Oil: With Russian crude making up 37% of India’s imports (often at $4/barrel discounts), refiners like Reliance and Indian Oil face profit squeezes if the penalty targets this trade. Reliance imports 500,000 barrels/day from Russia .

Comparative US Tariff Landscape (Effective Aug 1, 2025)

| Country/Bloc | Tariff Rate | Key Conditions/Exemptions | India’s Disadvantage |

|---|---|---|---|

| India | 25% + Penalty | Penalty for Russian oil & BRICS ties | Highest effective rate |

| Brazil | 50% | Political retaliation for Bolsonaro case | N/A |

| South Korea | 15% | Includes $350B US investment pledge | -10% rate difference |

| EU & Japan | 15% | Negotiated rates | -10% rate difference |

| Vietnam | 20% | Rises to 40% if Chinese transshipment found | -5% rate difference |

| China | Under Negotiation | Progress claimed, no delay announced | Unknown |

Diplomatic Crisis: From “Friends” to “Dead Economies”

The tariff announcement exposed a stunning collapse in US-India rapport. Within hours, Trump lashed out viciously: “I don’t care what India does with Russia. They can take their dead economies down together, for all I care” . This contempt was compounded by his simultaneous boast of an oil development deal with Pakistan—India’s arch-rival—taunting, “Who knows, maybe they’ll be selling Oil to India some day!” .

- Modi-Trump “Dosti” in Tatters: Prime Minister Narendra Modi’s much-publicized camaraderie with Trump—including a 2019 “Howdy Modi” rally—now appears a liability. India’s opposition Congress party slammed the tariffs as a “catastrophic failure of foreign policy,” noting Modi “hugged [Trump] like a long-lost brother” only to face harsh retaliation .

- Farmers: The Unbreakable Red Line: Commerce Minister Piyush Goyal told Parliament India attaches “utmost importance to protecting… our farmers,” signaling no retreat on agriculture—a key US demand. With over 40% of Indians reliant on farming, opening dairy and produce markets was politically untenable for Modi .

- Geopolitical Blow: The tariffs undermine a core US strategy: using India as a democratic counterweight to China. “Trust has diminished,” said Asia Group advisor Ashok Malik. “President Trump’s messaging has damaged many years of careful, bipartisan nurturing of the U.S.-India partnership” .

The Road Ahead: Damage Control in a Hostile Landscape

India’s immediate response has been cautious but resolute. Goyal stated the government is “examining the implications” and “will take all necessary steps to safeguard our national interest” . Economists suggest possible paths:

- Negotiation Push: Talks continue through August, with a US team expected in India soon. Best-case may reduce tariffs to 15-20%, still worse than Japan/EU rates .

- Domestic Stimulus: The Reserve Bank of India may enact “deeper rate cuts” to offset growth headwinds .

- Export Pivot: Accelerating trade deals with the EU, UK, and Gulf states to diversify away from US dependence.

- BRICS Solidarity: Trump’s penalty may push India closer to the bloc he seeks to weaken, particularly on energy trade and dollar alternatives.

Trump’s tariffs are more than an economic shock—they’re a strategic earthquake. By explicitly punishing India for sovereign choices (Russian oil) and geopolitical alignment (BRICS), the US risks alienating the very partner it needs to balance China in Asia. While an 11th-hour deal could soften the blow, the trust underpinning the relationship lies fractured. As exporter orders evaporate and the rupee tumbles, India faces a harsh new reality: in Trump’s zero-sum world, even “friends” get tariff-hammered when they defy Washington’s will . The golden age of US-India relations is over; the age of punitive reciprocity has begun.