Union Commerce and Industry Minister Piyush Goyal has expressed strong confidence in India’s trade performance, predicting that outbound shipments will exceed the previous year’s figures despite global headwinds like geopolitical tensions and tariff barriers. Speaking at an industry event in New Delhi on August 30, 2025, Goyal emphasized the nation’s resilience and strategic positioning to capture new markets, underscoring ongoing efforts to expand free trade agreements and enhance domestic competitiveness. This optimistic outlook comes amid a challenging international landscape, where economic uncertainties have dampened global demand, yet India’s diversified export base continues to show promise.

Goyal’s Assurance Amid Trade Challenges

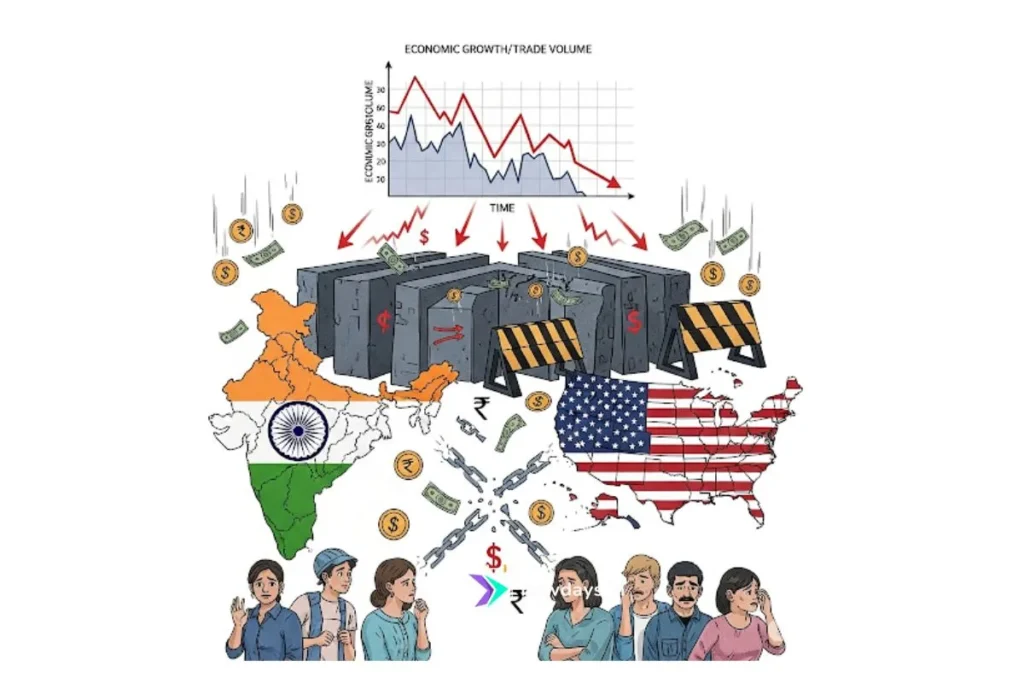

Goyal’s remarks highlight India’s ability to navigate obstacles, including recent US tariffs on certain goods reaching 50%. He assured stakeholders that the country would not compromise on self-respect or bow to discriminatory practices, while pledging government support to help exporters explore alternative destinations. “Our exports will surpass last year’s levels, driven by innovation and global outreach,” he stated, pointing to the record $824.9 billion achieved in FY 2024-25 as a foundation for further growth.

The minister outlined plans to finalize trade pacts with nations like the UK, European Union, Oman, and Saudi Arabia, which could open doors for sectors such as textiles, engineering, and pharmaceuticals. He also mentioned Australia’s interest in advancing its existing agreement, potentially boosting bilateral volumes. These initiatives aim to mitigate impacts from external pressures, with Goyal noting that affected industries have shown no signs of distress and remain committed to expansion.

Key Points: Export Performance and Projections

- Previous Year’s Achievement: FY 2024-25 saw total exports hit $824.9 billion, a 6% rise from $778.1 billion in FY23-24, driven by services and merchandise growth.

- FY25-26 Target: Government eyes $1 trillion, with merchandise at $525-535 billion (up 12%) and services at $465-475 billion (up 20%).

- Sectoral Drivers: Electronics, chemicals, pharmaceuticals, and agriculture expected to lead; petroleum and gems to rebound.

- Policy Support: Focus on FTAs, PLI schemes, and digital trade to cut costs and enhance efficiency.

- Global Context: Amid recessions in Western markets, India’s resilience stems from diversification and stable domestic growth.

These figures align with FIEO estimates, which project robust expansion despite a forecasted 1% global trade growth by the WTO.

Expert Opinions: Optimism Tempered by Caution

Analysts largely echo Goyal’s positivity. FIEO President S C Ralhan, in a PTI interview, attributed May 2025’s 2.8% export rise to $71.12 billion to strong services performance, saying, “With stabilizing global conditions in H2 2025, India is poised for accelerated growth.” He highlighted PLI schemes yielding results in value-added manufacturing.

On YouTube, economic channels like those with over a million subscribers analyze the forecast. One expert noted, “Goyal’s confidence is backed by data—electronics exports up 20%—but geopolitical risks like Red Sea disruptions could add 2-3% to costs.” Videos reference World Bank projections of India’s economy growing 6.6% in FY26, outpacing global averages.

Economists from DBS Bank, in a report, foresee India overtaking the UK as the fifth-largest economy, with exports benefiting from supply chain shifts. However, they caution, “Recessions in key markets and currency fluctuations pose risks; diversification is crucial.”

Critics like those in Business Standard warn of over-optimism: “Tariffs could dent $46 billion in US exports; real growth depends on quick FTA closures.”

Analyzing Goyal’s Forecast: Resilience Meets Reality

Goyal’s prediction reflects India’s export trajectory, which defied global slowdowns in FY25 with 6% growth amid wars and inflation. Strengths include a diversified basket—services at 47% of exports—and policies like Gati Shakti, reducing logistics costs from 14% to 10% of GDP per DPIIT data.

Positively, FTAs with UAE and Australia have boosted trade by 20-30%, per ministry figures, positioning India to capture shares from China. EEPC India’s chairman noted engineering exports’ stability despite challenges, signaling sectoral robustness.

Challenges loom: US tariffs hit labor-intensive goods like textiles, potentially costing $5-10 billion annually without offsets. IMF warnings of 1% global trade growth in 2025 add pressure, with India’s reliance on Western markets (40% of exports) a vulnerability.

Long-term, experts like those from NITI Aayog project $1 trillion by FY26 if reforms continue, adding 1-2% to GDP via jobs and forex. YouTube analyses suggest digital tools and green initiatives could enhance competitiveness.

In essence, Goyal’s outlook embodies cautious optimism—India’s exports are set for growth, but success hinges on agile policies and global recovery. As the fiscal year progresses, stakeholders will watch if resilience translates to record highs.

1 thought on “Piyush Goyal on India’s Export Growth: What to Expect in 2025”