The corridors of power in Washington have reverberated with an unprecedented ultimatum that could reshape global energy markets and test the resilience of India’s foreign policy doctrine. Senator Lindsey Graham’s stark warning to India, China, and Brazil to halt Russian oil purchases or face economic destruction has crystallized into the most aggressive sanctions threat yet, positioning the world’s largest democracy at the crossroads of energy security and geopolitical alignment.

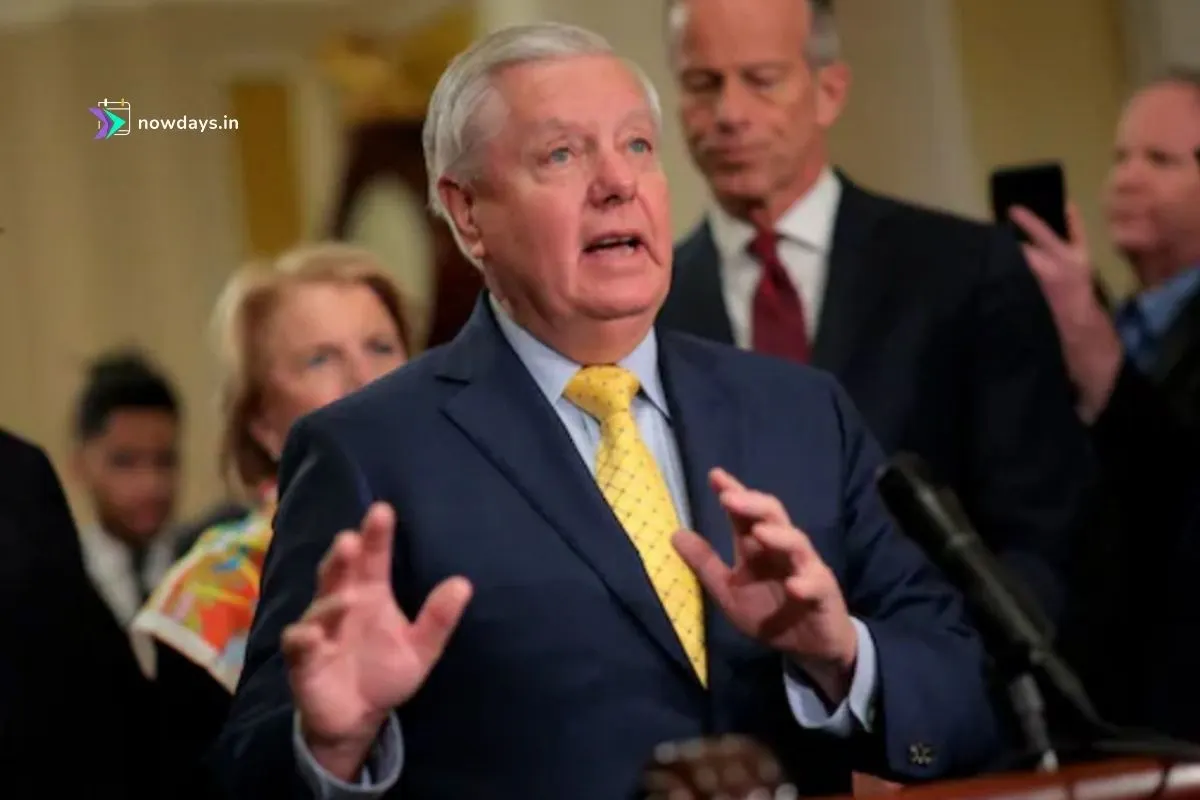

The Warning Shot: Graham’s “Economic Bunker Buster”

In a forceful television interview that sent shockwaves across diplomatic circles, Republican Senator Lindsey Graham delivered what he termed an “economic bunker buster” against nations sustaining Russia’s war machine. “Trump is going to impose tariffs on people that buy Russian oil – China, India, and Brazil,” Graham declared, warning that these three countries, which collectively purchase 80% of Russia’s crude exports, are directly funding Putin’s military campaign.

Graham’s rhetoric escalated dramatically with a personal message to the targeted nations: “If you keep buying cheap Russian oil to allow this war to continue, we’re going to tear up the hell out of you and we’re going to crush your economy, because what you’re doing is blood money“. The senator’s inflammatory language signals a fundamental shift in American diplomatic strategy, moving from traditional economic pressure to direct threats of financial warfare.

Lindsey Graham: Here’s what I would tell China, India and Brazil. If you keep buying cheap Russian oil… we will tariff the hell out of you and we’re going to crush your economy pic.twitter.com/x05J3G8oOk

— Acyn (@Acyn) July 21, 2025

The warning carries particular weight given Graham’s significant congressional support. The Sanctioning Russia Act of 2025, which he co-sponsored with Democrat Richard Blumenthal, has garnered 85 cosponsors in the Senate and proposes an eye-watering 500% tariff on imports from countries purchasing Russian energy. This bipartisan backing suggests the threat extends beyond partisan politics into strategic American interests.

Read more: As MAGA Revolt Over Epstein Files Intensifies, Is Trump Administration Under Threat?

India’s Energy Reality: The Numbers Don’t Lie

India’s transformation into Russia’s second-largest oil customer represents one of the most dramatic shifts in global energy trade patterns in recent history. Before the Ukraine conflict, Russian oil constituted less than 1% of India’s crude imports6. Today, that figure has skyrocketed to approximately 35-40% of total imports, making Russia India’s largest oil supplier for three consecutive years.

The scale of this dependency is staggering. India imported 2.08 million barrels per day (bpd) of Russian crude in June 2025, the highest level since July 2024. Over the first half of 2025, Russia supplied 1.67 million bpd to India, maintaining its position as the dominant supplier despite growing international pressure7. This translates to approximately $50.3 billion worth of Russian crude imports in fiscal year 2024-25, representing over one-third of India’s total crude oil expenditure of $143.1 billion.

The financial implications are profound. Since the Ukraine war began, India has spent an estimated €112.5 billion ($121.59 billion) on Russian crude oil alone, according to the Centre for Research on Energy and Clean Air. This massive financial commitment has fundamentally altered India’s energy security calculations, providing substantial cost savings through discounted Russian oil while creating dangerous strategic vulnerabilities.

The Economic Sword of Damocles

The proposed sanctions regime represents the most comprehensive economic pressure campaign ever contemplated against major trading partners. Graham’s legislation would grant President Trump unprecedented powers to impose 500% tariffs on all imports from countries purchasing Russian energy. For India, currently facing a potential 26% reciprocal tariff from the US if no trade deal is reached by August 1, the additional sanctions could create prohibitive barriers to bilateral commerce.

The economic mathematics are sobering. India’s total trade with the United States reached approximately $118 billion in 2023-24, making America one of India’s largest trading partners. The threatened tariffs would effectively freeze this trade relationship, forcing Indian businesses to choose between profitable Russian energy and access to the lucrative American market.

More immediately threatening is the impact on India’s $15 billion petroleum export business to the European Union. New EU sanctions already ban imports of refined petroleum products made from Russian crude oil, directly targeting Indian refineries that process Russian oil and export the finished products to European markets. Combined with American tariffs, this two-pronged assault could devastate India’s refining sector, which has become increasingly dependent on cheap Russian feedstock.

The Administration’s Calculated Pressure

The sanctions threat represents a carefully orchestrated campaign involving multiple levels of American leadership. President Trump’s 50-day ultimatum to Russia, threatening 100% secondary tariffs if Moscow doesn’t agree to a Ukraine peace deal, provides the timeline framework for the pressure campaign. This deadline creates a ticking clock under which India must make fundamental strategic choices.

White House officials have clarified that Trump’s “secondary sanctions” specifically target countries buying Russian oil, not Russia itself. This distinction reveals the administration’s strategy: rather than directly confronting Moscow, Washington seeks to collapse Russia’s customer base, thereby strangling its revenue streams. As one official explained: “It’s sanctions on countries that are buying the oil from Russia. So it will dramatically impact the Russian economy”.

The threat gains credibility from Graham’s legislative momentum. The senator claims to have 84 co-sponsors for his sanctions bill, describing it as providing Trump with “maximum flexibility” to “dial the tariffs up or down”. This discretionary power would allow the administration to reward compliance or punish defiance on a country-by-country basis, creating powerful incentives for immediate policy changes.

NATO Secretary General Mark Rutte has amplified the pressure, warning that India, China, and Brazil will be hit “very hard” by sanctions if they continue Russian trade19. His call for these nations to “pressure Vladimir Putin” directly links their energy choices to broader geopolitical alignment, suggesting the sanctions are part of a comprehensive strategy to isolate Russia diplomatically and economically.

India’s Defiant Response: Standing Ground

Despite the mounting pressure, India’s response has been characterized by diplomatic firmness and strategic defiance. Oil Minister Hardeep Singh Puri has emerged as the primary voice of resistance, declaring that India is “not unduly worried” about potential sanctions. His confidence stems from India’s successful diversification strategy, expanding oil supply sources from 27 countries in 2007 to 40 countries currently.

Puri’s analysis reveals the global stakes involved: “Russia is 10% of global production. Our analysis indicates that, without Russia, prices would have gone to $130 a barrel”. This argument positions India’s Russian oil purchases not as geopolitical defiance but as global economic stabilization, suggesting that halting these imports would harm the entire world economy through energy price inflation.

External Affairs Ministry spokesperson Randhir Jaiswal has provided the diplomatic framing, stating that “securing energy needs of our people is understandably an overriding priority” while cautioning against “any double standards” in American and European policies. This response highlights the perceived hypocrisy in Western demands, particularly given Europe’s continued dependence on Russian energy imports.

The “double standards” argument carries particular force given recent data showing that Russian gas imports by the European Union actually rose during 2024, despite declared efforts to reduce dependence. India’s officials argue that while demanding Indian compliance, Western nations continue their own Russian energy relationships, undermining the moral authority of sanctions threats.

The Global Energy Chess Game

The confrontation over Russian oil reflects broader geopolitical realignments that extend far beyond bilateral trade disputes. Russia’s success in redirecting its energy exports from West to East has created new power dynamics that challenge traditional American economic dominance. According to Russian Deputy Energy Minister Roman Marshavin, “demand exceeds available volumes” for Russian oil among BRICS partners, with “everything contracted and few new available volumes”.

This supply-demand imbalance has strengthened Russia’s bargaining position while creating competition among buyers. China and India together now account for 78% of Russian crude exports, compared to just 32% in 2021. This massive shift has reduced Russian dependence on Western markets while providing Moscow with reliable revenue streams to sustain its military operations.

The American sanctions strategy aims to reverse this trend by making Russian oil purchases economically prohibitive. However, the effectiveness depends on global cooperation, particularly from major economies like India that have developed alternative payment mechanisms and supply chains. The emergence of what analysts call a “shadow fleet” of oil tankers and the development of non-dollar payment systems have created workarounds that complicate enforcement.

For India, the energy relationship with Russia extends beyond mere commercial transactions. The discounted pricing has provided substantial economic benefits, helping control domestic inflation while supporting the government’s energy security objectives. Industry estimates suggest that Indian refiners have saved billions of dollars through Russian crude purchases, money that has supported economic growth and development programs.

The Technology and Infrastructure Challenge

The threatened sanctions would force India to rapidly reconfigure its energy infrastructure, a challenge with significant technical and financial implications. Indian Oil Corporation Chairman A.S. Sahney has indicated that “if Russian supplies are disrupted, we will go back to the same supply template as was used pre-Ukraine crisis when Russian supplies to India were below 2%”.

However, this transition would not be seamless. India’s refinery infrastructure has adapted to Russian crude specifications, and switching suppliers requires technical adjustments, new logistics arrangements, and potentially higher costs. The country’s two largest private refiners, Reliance Industries and Nayara Energy, have structured long-term contracts around Russian supplies and collectively account for nearly half of total Russian oil purchases.

The EU’s recent sanctions specifically targeting Nayara Energy, which is partially owned by Russian oil giant Rosneft, demonstrate how quickly geopolitical pressures can impact commercial relationships. These targeted measures create additional compliance burdens and operational risks for Indian companies engaged in Russian energy trade.

Alternative suppliers exist but come with different pricing structures and delivery timelines. Puri has identified Guyana, Brazil, and Canada as potential sources for additional supply, while noting that US crude imports to India surged over 50% in the first half of 2025. However, replacing Russian volumes would likely result in higher costs and reduced refining margins, potentially impacting India’s energy security and economic competitiveness.

The Diplomatic Tightrope

India’s response to American pressure reflects its broader strategic doctrine of “strategic autonomy,” which emphasizes independent decision-making based on national interests rather than alliance obligations. External Affairs Minister S. Jaishankar has acknowledged that India’s “concerns and interests in energy security have been made conversant” to Senator Graham during recent diplomatic exchanges.

This diplomatic engagement suggests India is not simply dismissing American concerns but rather seeking to explain its position and negotiate acceptable compromises. The government has consistently argued that India’s Russian oil purchases actually serve global interests by preventing energy price spikes that would harm the world economy.

The challenge for Indian diplomacy lies in maintaining relationships with both sides of the Ukraine conflict while protecting core national interests. India’s traditional non-aligned stance faces unprecedented pressure as great powers demand explicit choices on fundamental security issues. The energy sanctions represent just one front in this broader strategic competition.

Prime Minister Modi’s government must also consider domestic political implications. Energy price inflation could undermine economic growth and create political vulnerabilities, particularly given India’s large population of price-sensitive consumers. Maintaining affordable energy access is thus both an economic and political imperative.

The Economic Ripple Effects

The potential implementation of American sanctions would create cascading effects throughout the Indian economy beyond the energy sector. India’s petroleum product exports worth $15 billion to the EU are already at risk due to European sanctions on Russian crude-derived products. Adding American tariffs would compound these losses, potentially affecting hundreds of thousands of jobs in the refining and petrochemical sectors.

The broader economic implications extend to currency stability and inflation management. India’s current account deficit, already a concern for policymakers, could worsen significantly if energy import costs rise due to supplier changes. The rupee might face additional pressure, creating inflationary spirals that could undermine economic growth.

Trade economists warn that the sanctions could trigger retaliatory measures, potentially escalating into a broader trade war. India’s $118 billion bilateral trade relationship with the United States encompasses numerous sectors beyond energy, including information technology services, pharmaceuticals, and textiles. Disrupting this relationship would harm both economies and potentially destabilize global supply chains.

The timing is particularly challenging given India’s aspirations for enhanced economic integration with global markets. The country has been seeking to leverage its demographic advantages and manufacturing capabilities to become a major global economic power. Extended trade conflicts with major partners could derail these ambitions and force India toward greater reliance on emerging market partnerships.

The Global Market Response

Financial markets have begun pricing in the potential for significant disruptions to global energy trade. Oil prices have shown volatility in response to sanctions threats, though the 50-day deadline has somewhat moderated immediate supply concerns. Analysts at ING noted that implementation of Trump’s threatened sanctions “would significantly change the outlook for the oil market”.

The prospect of removing 5 million barrels per day of Russian oil from global markets through demand destruction has created concerns about supply adequacy and price stability. Energy expert Alexander Kolyandr warned that such measures would be “extremely painful for the United States also” due to resulting price increases.

International shipping and insurance markets have also begun adjusting to potential sanctions enforcement. The designation of additional vessels in Russia’s “shadow fleet” and restrictions on maritime services could create logistics bottlenecks that affect global energy transportation, not just Russian shipments.

However, market participants remain skeptical about full implementation of the threatened measures. The potential economic damage to American and European consumers, combined with inflationary pressures, may ultimately limit the scope of actual sanctions. This skepticism has prevented more dramatic market reactions despite the severe rhetoric from Washington.

The Path Forward: Choices and Consequences

As the 50-day deadline approaches, India faces a fundamental strategic choice between energy security and geopolitical alignment. The government’s initial response suggests a preference for maintaining current policies while seeking diplomatic solutions. However, the scale of threatened economic retaliation may eventually force more significant adjustments.

Several scenarios appear possible. India might negotiate partial compliance, reducing Russian oil imports while maintaining some trade relationships. Alternatively, the government could seek to build coalitions with other targeted countries, particularly China and Brazil, to resist American pressure collectively. A third option involves accelerating diversification efforts while accepting higher energy costs as a price for avoiding sanctions.

The broader implications extend beyond India to the entire global energy system. The American sanctions threat represents an attempt to weaponize economic relationships for geopolitical objectives, setting precedents that could reshape international trade. The success or failure of this pressure campaign will influence how great powers approach similar disputes in the future.

For India, the immediate priority remains managing the economic transition while preserving strategic relationships with all major powers. The country’s response will likely emphasize diplomatic engagement, gradual diversification, and continued emphasis on national interest over alliance obligations.

A Defining Moment

Senator Graham’s ultimatum to India represents more than a trade dispute—it constitutes a fundamental test of whether economic interdependence can be subordinated to geopolitical objectives in the modern global system. India’s response will determine not only its energy future but also its position in the emerging multipolar world order.

The stakes extend far beyond oil imports. India’s choices will influence its relationships with the United States, Russia, and other major powers for decades to come. The country’s ability to maintain strategic autonomy while managing economic pressures will serve as a model for other emerging economies facing similar dilemmas.

As the 50-day clock ticks down, the world watches to see whether economic realities or geopolitical pressures will ultimately prevail. India’s response may well determine the future architecture of global energy markets and the limits of American economic coercion in an increasingly multipolar world.

The confrontation between Senator Graham’s threats and India’s energy needs represents a collision between great power politics and economic necessity. How this collision resolves will shape the contours of international relations for years to come, making it one of the most consequential diplomatic crises of the contemporary era.

1 thought on “Lindsey Graham to India: Stop Buying Russian Oil or Face Economic Retaliation”