Santa Clara / Washington D.C., July 15, 2025 – In a seismic shift for the global semiconductor industry, Advanced Micro Devices (AMD) has received U.S. government clearance to restart shipments of its flagship MI308 artificial intelligence chips to China—ending a costly three-month embargo that threatened to reshape the AI technology landscape. The breakthrough, confirmed by the Department of Commerce today, signals a strategic de-escalation in the U.S.-China tech war and injects new life into AMD’s $6.23 billion Chinese market stronghold .

⚡ The Announcement: How the Blockade Lifted

- Licensing Greenlight: The Commerce Department informed AMD that export license applications for MI308 AI accelerators will “move forward for review”—a procedural step widely interpreted as pre-approval. AMD immediately stated it “plans to resume shipments as licenses are approved” .

- Nvidia Parallels: The decision mirrors the Trump administration’s simultaneous clearance of Nvidia’s H20 AI chips for China, confirming a coordinated policy shift targeting specialized AI processors .

- Market Euphoria: AMD shares surged 5% in pre-market trading—adding ~$15B to its market cap—as investors priced in recovered revenue streams and reduced inventory write-off risks .

Read more: Tesla Model Y Launched in India: Dual Variants, 4.6s 0–96 km/h, 526 km EPA Range

💰 The $800M Sting: Why the Ban Devastated AMD

Before today’s reversal, the MI308 export blockade had triggered a financial crisis for AMD:

- Revenue Blackhole: AMD projected $800 million in losses from stranded inventory, canceled contracts, and reserves—equivalent to 16% of its 2024 Instinct GPU revenue .

- Strategic Paralysis: The MI308—a purpose-built variant of AMD’s MI300X, engineered to comply with 2023 U.S. rules—was suddenly barred in April 2025 under tightened restrictions targeting China’s military AI capabilities .

- Competitive Surrender: With China representing 24% of AMD’s global revenue ($6.23B in 2024), the freeze ceded ground to rivals like Nvidia and accelerated China’s domestic chip development .

Table: Financial Impact of U.S. Chip Export Controls (April-July 2025)

| Company | Chip Affected | Projected Loss | China Revenue Exposure |

|---|---|---|---|

| AMD | MI308 AI Accelerator | $800 million | 24% ($6.23B in 2024) |

| Nvidia | H20 GPU | $5.5 billion | 22% (~$15B in 2024) |

🧩 Behind the Policy Reversal: Geopolitics Over National Security?

This unexpected thaw stems from complex economic and diplomatic forces:

- CEO Diplomacy: Nvidia CEO Jensen Huang’s high-stakes meetings with President Trump last week—followed by his Beijing tour—paved the way. Huang publicly argued that blocking chip sales would weaken U.S. influence by pushing China toward homegrown alternatives .

- Trade War Detente: The move coincides with China relaxing rare earth mineral export controls and the U.S. permitting chip design tools to flow back into China—suggesting a broader bilateral de-escalation .

- The “Tech Stack” Argument: Huang and AMD executives successfully lobbied that America’s AI leadership requires global adoption of U.S. semiconductor ecosystems. As Huang stated: “We want the American tech stack to be the global standard” .

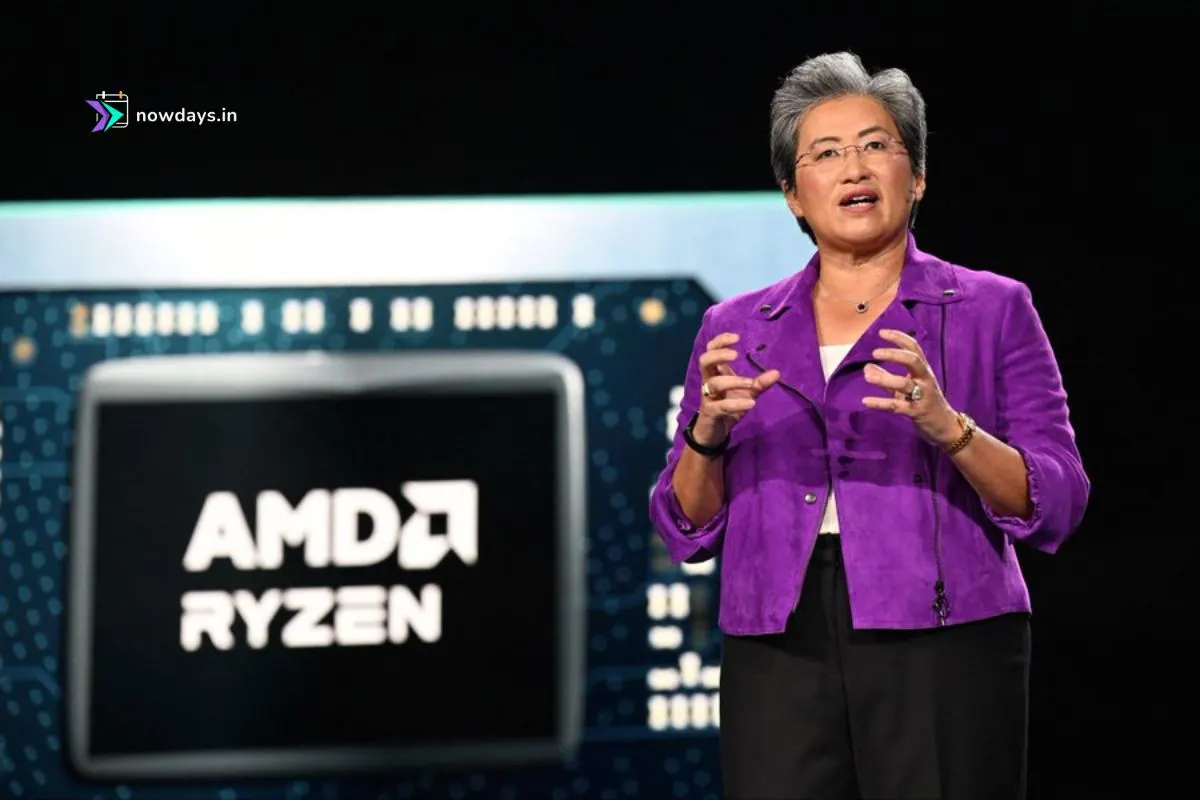

⚙️ Inside the MI308: AMD’s China-Specific Powerhouse

- Engineered for Compliance: Unlike unrestricted MI300X chips, the MI308 features reduced floating-point performance and slashed interconnect bandwidth to meet U.S. export thresholds—placing it competitively near Nvidia’s H20 .

- AI Workload Focus: Designed for hyperscale data centers, large language model training, and cloud AI services—precisely the applications Chinese tech giants like Tencent and ByteDance are aggressively scaling .

- Software Locked: Contains firmware-level restrictions making it difficult to redeploy outside China, easing U.S. security concerns .

🌐 Market Impact: Scramble, Strategy, and Uncertainty

- Chinese Rush to Order: Multiple sources confirm Chinese firms are “scrambling to place orders” for MI308 and H20 chips. ByteDance and Tencent are already submitting procurement applications .

- Huawei’s Window Closes: The restart disrupts plans by Huawei and other Chinese chipmakers to fill the void with domestic alternatives like the Ascend 910B .

- Investor Relief ≠ Stability: While AMD and Nvidia stocks jumped, analysts warn the reprieve could be temporary. As Omdia’s He Hui notes: “Chinese companies will continue diversifying options to protect supply chains” .

Read more: BREAKING: Elon Musk’s xAI Signs First Deal with U.S. Department of Defense

🚀 What’s Next: Logistics, Licensing, and Long-Term Risks

- Licensing Timeline: AMD must now file individual customer licenses with Commerce—a process that could take weeks. Shipments likely resume by Q3 2025 .

- Revenue Recovery: The $800M impairment charge could be partially reversed if shipments scale rapidly. Jefferies estimates China could deliver $1.2–1.8B in incremental AMD revenue by 2026 .

- The 2026 Wildcard: A potential new Trump administration could reimpose restrictions post-election, especially if U.S.-China tensions flare over Taiwan or AI militarization .

💡 The Big Picture: Tech Nationalism Meets Capitalist Realism

AMD’s MI308 clearance reveals the contradictions of modern tech statecraft:

“We applaud the progress made by the Trump Administration in advancing trade negotiations and its commitment to U.S. AI leadership”

— AMD Official Statement

While national security hawks warn of AI dual-use risks, semiconductor giants wield irresistible economic logic: $50 billion in combined China revenue for AMD and Nvidia . This tension won’t disappear—today’s “win” merely postpones a reckoning between techno-nationalism and globalized capitalism.

For now, though, AMD’s warehouses full of mothballed MI308 chips will finally ship. China’s AI labs will regain access to cutting-edge silicon. And in Washington and Beijing, a temporary truce holds—proving that even in a tech cold war, money talks.

— With supply chain intelligence from Mumbai, Beijing, and San Jose.

4 thoughts on “AMD Cleared to Resume MI308 AI Chip Shipments to China, Ending $800M Standoff”