The India-UK Free Trade Agreement (FTA), formally signed on July 24, 2025, represents a landmark achievement in bilateral trade relations, designed to significantly enhance economic activity and foster deeper cooperation between the two nations. This comprehensive agreement is projected to increase overall bilateral trade by nearly 39% in the long run, equating to an additional £25.5 billion annually. It is also expected to contribute to Gross Domestic Product (GDP) growth in both countries, with the UK’s GDP estimated to rise by 0.13% (£4.8 billion) and India’s GDP by 0.06% (£5.1 billion) per year over the long term. The primary driver of this anticipated growth is the substantial reduction and elimination of tariffs, coupled with enhanced market access for services and streamlined professional mobility.

Key sectors positioned for significant benefits include:

For the UK: Critical sectors such as Spirits (Whisky, Gin), Automotive (Cars, Parts), and a variety of Consumer Goods will become more competitive within the Indian market due to reduced tariffs. The UK’s globally recognized Services industry, particularly in Financial, Environmental, and Construction services, stands to benefit from guaranteed market access and new opportunities within India’s public procurement landscape.

For India: Labor-intensive industries such as Textiles, Apparel, Leather Goods, Marine Products, Agricultural and Processed Foods, Gems & Jewellery, and Toys are set to gain substantially from near-total duty-free access to the UK market. Furthermore, Engineering Goods, Auto Components, Pharmaceuticals, and India’s burgeoning Services sector, encompassing IT, financial, legal, and educational services, are expected to receive considerable impetus.

This FTA is structured to generate thousands of new jobs, attract fresh investments, and provide tangible advantages to consumers through increased affordability and a wider selection of goods. It also incorporates forward-looking provisions concerning digital trade, support for Small and Medium-sized Enterprises (SMEs), and commitments towards gender equality, thereby positioning the agreement as a strategic blueprint for shared prosperity and a resilient economic partnership in an evolving global trade environment.

A New Era of India-UK Trade Relations

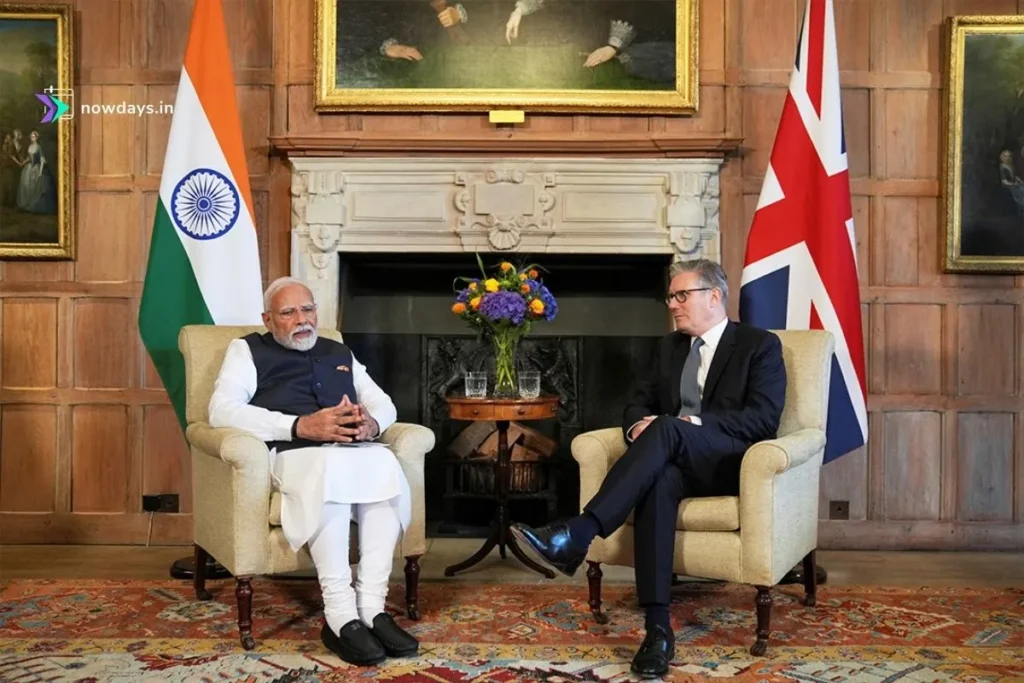

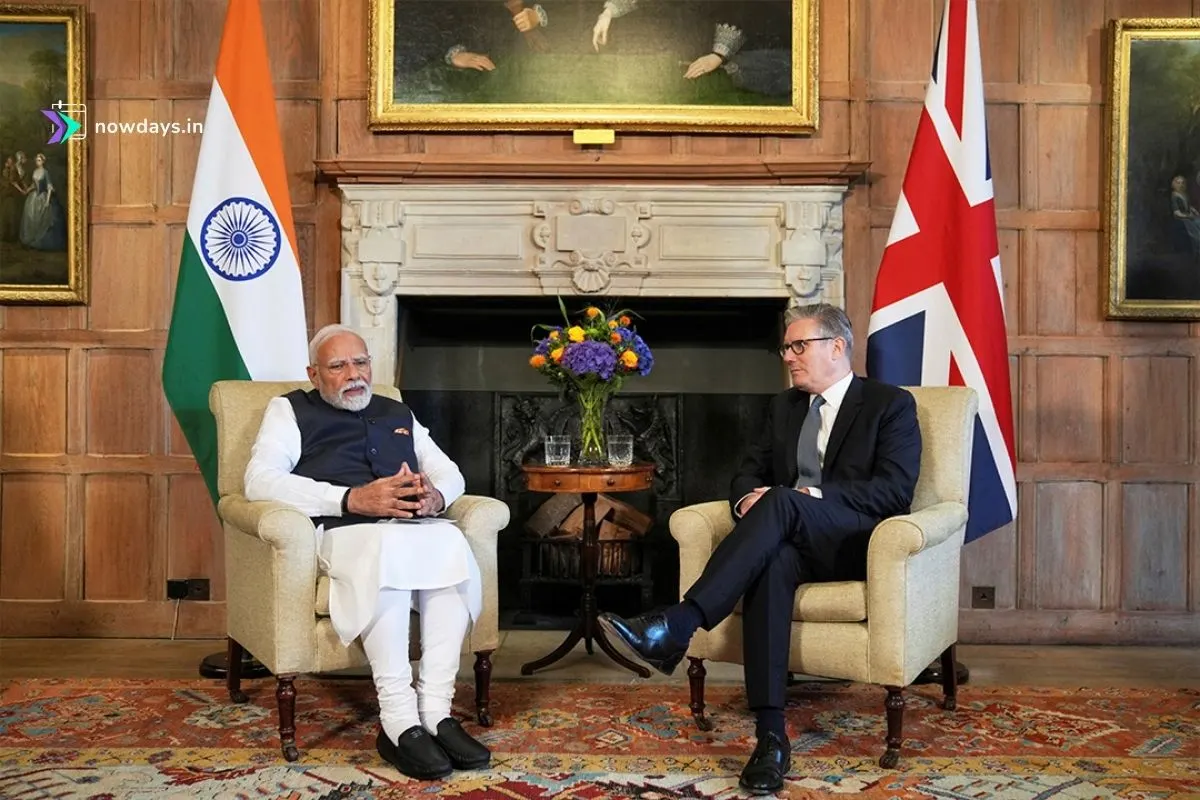

The formal signing of the India-UK Free Trade Agreement on July 24, 2025, marks a pivotal moment, underscoring a reinforced commitment to bilateral economic growth and strategic collaboration between India and the United Kingdom. This agreement, finalized in the presence of Prime Minister Narendra Modi and British Prime Minister Keir Starmer, is the culmination of over three and a half years of intricate negotiations. It has been hailed as the most significant trade deal India has ever secured and represents the largest and most economically impactful trade agreement for the UK since its departure from the European Union.

The overarching purpose of the FTA is to diminish tariffs and non-tariff barriers, thereby simplifying, accelerating, and reducing the cost of trade for businesses in both nations. It aims to foster greater predictability and transparency in bilateral commerce, stimulating economic expansion and supporting the creation of employment opportunities.

A central component of this agreement is the extensive tariff reduction and elimination:

- For Indian Exports to the UK: The UK will grant duty-free access to 99% of Indian product lines, encompassing nearly 100% of the total trade value. This includes substantial reductions for marine products, where duties previously stood at 20%, textiles and clothing at 12%, chemicals at 8%, and base metals at 10%. Notably, for processed food items, duties on 99.7% of products, which were as high as 70%, have been entirely removed.

- For UK Exports to India: India, in turn, will reduce tariffs on approximately 90% of UK goods, leading to its average levy decreasing from 15% to 3%. Around 85% of these products are slated to become completely tariff-free over a ten-year implementation period.

The agreement sets ambitious trade value targets, aiming to more than double bilateral trade from the current $56 billion to $120 billion by 2030. Projections indicate that bilateral trade will increase by nearly 39% in the long run, amounting to an additional £25.5 billion annually.

Beyond goods, the FTA guarantees access for the UK’s globally recognized services industry, ensuring equitable treatment for sectors such as financial services, environmental services, and construction services operating in India. India’s rapidly expanding services sector, including IT, financial, legal, and educational services, is also expected to receive a significant boost.

A crucial aspect of the agreement addresses professional mobility, featuring simplified visa processes and liberalized entry categories for Indian professionals, including engineers, architects, chefs, yoga instructors, and musicians, entering the UK. A notable achievement for India is the inclusion of the Double Contribution Convention, which exempts Indian workers in the UK for up to three years from UK social security contributions, a provision anticipated to benefit 75,000 workers.

The agreement also includes provisions for digital trade, with commitments to promote system compatibility and paperless transactions, making cross-border commerce more efficient and cost-effective. Furthermore, bespoke support, including dedicated contact points, will be established for SMEs to facilitate their market entry and trade activities.

In terms of investment and public procurement, the deal is expected to generate new investment and export opportunities, with projections of nearly £6 billion for Britain, leading to the creation of over 2,200 UK jobs. India has also opened an estimated 40,000 central government contracts above a certain value to UK businesses, granting them local contractor status.

The FTA’s focus extends beyond mere trade volume and tariff adjustments. The inclusion of provisions for digital trade, support for SMEs, gender equality, and development indicates a strategic intent to build a modern, comprehensive partnership. The emphasis on labor-intensive sectors for India, such as textiles, leather, and marine products, coupled with the protection of sensitive agricultural sectors, suggests India’s carefully considered approach to liberalization, prioritizing domestic job creation and safeguarding local interests. Similarly, the UK’s focus on services and high-value manufacturing, exemplified by sectors like whisky and automotive, aligns with its post-Brexit economic strategy.

This comprehensive scope suggests that the FTA is not merely a transactional trade agreement but a foundational document for a broader strategic alliance, aiming for inclusive growth and resilience in a dynamic global environment. It reflects a mutual understanding of each nation’s economic priorities and sensitivities, establishing a framework for shared prosperity.

Read more: Amazon Lists Nearly 5,500 H-1B Job Openings with $153K Median Salary

Benefits for India: Driving Export Growth and Economic Diversification

The India-UK FTA is positioned to serve as a significant catalyst for India’s export-driven economic expansion, offering unparalleled market access to the UK and fostering diversification across a wide array of sectors. A cornerstone of the agreement is the assurance that 99% of India’s exports will receive duty-free access to the UK market, effectively covering nearly the entire bilateral trade basket.

Goods Sectors

- Textiles, Apparel, and Leather Goods: India’s textiles and clothing sector is set to receive duty-free access across 1,143 distinct product categories. This provision marks a substantial advantage, effectively eliminating the tariff disadvantage India previously encountered when competing with nations like Bangladesh and Cambodia. This strategic move is expected to significantly enhance India’s competitive standing in the UK market, which currently imports approximately $26.95 billion worth of textiles annually, with India’s current contribution being a mere $1.79 billion. Projections indicate that key sub-sectors such as ready-made garments, home textiles, carpets, and handicrafts are poised for exponential growth, with India potentially gaining at least 5% more market share in the UK within the next one to two years. In the leather and footwear segment, the removal of 16% tariffs is expected to propel exports beyond the $900 million mark, providing substantial benefits to Micro, Small, and Medium Enterprise (MSME) hubs located in cities such as Agra, Kanpur, Kolhapur, and Chennai. Notably, iconic Indian products like Kolhapuri chappals, a type of handcrafted leather footwear, will also enjoy tariff-free entry into the UK’s high-end marketplace. The emphasis on duty-free access for labor-intensive sectors like textiles, apparel, and leather goods directly links trade policy to domestic job creation and socio-economic development. The specific mention of strengthening women’s participation in traditional handlooms, heritage crafts, and the textile industry highlights a deliberate strategy to leverage the FTA as a mechanism for women’s empowerment and their integration into global supply networks. This indicates that the benefits of the FTA are not solely measured in economic metrics but also encompass inclusive growth, poverty reduction, and support for vulnerable segments of the workforce, particularly women in traditional and artisanal sectors.

- Agricultural and Processed Food Products: Indian agricultural products, including turmeric, cardamom, pepper, mango pulp, pickles, and pulses, will now benefit from duty-free access to premium UK markets. This provision offers Indian farmers more favorable terms compared to many European competitors, such as Germany and the Netherlands. Agricultural exports from India to the UK are projected to increase by over 20% in the next three years, driven by the elimination of duties on more than 95% of India’s agricultural and processed food items. This aligns with and supports India’s ambitious goal of achieving $100 billion in agricultural exports by 2030. The FTA also creates new avenues for innovative products such as jackfruit, millets, vegetables, and organic herbs, thereby supporting agricultural diversification and contributing to domestic price stability. Crucially, India has strategically maintained existing tariffs on sensitive agricultural sectors, including dairy products, apples, oats, and edible oils, to safeguard domestic interests and ensure food security. The significant reduction in tariffs for processed foods, with 99.7% of lines previously subject to duties as high as 70% now enjoying duty-free access, signifies a profound shift beyond merely exporting raw agricultural produce. This encourages substantial value addition within India, transforming agricultural raw materials into higher-margin processed goods. The competitive advantage gained over European exporters implies a potential reorientation of global supply chains for these products, with India poised to capture a larger share. This aspect of the FTA is therefore seen as a transformative force for India’s agriculture and food processing industries , not only in terms of boosting export volume but also in elevating the entire agricultural value chain and strengthening India’s position as a significant global food supplier.

- Marine Products: The removal of duties, which previously ranged from 4.2% to 8.5%, on 99% of marine product exports, including shrimp, tuna, fishmeal, and feeds, unlocks a substantial $5.4 billion marine export opportunity for India. India currently holds only a 2.25% share in the UK’s marine import market, indicating significant room for growth. This sector is expected to provide considerable advantages to coastal states such as Andhra Pradesh, Odisha, Kerala, and Tamil Nadu, which are major contributors to India’s marine economy.

- Gems, Jewellery, Toys, and Sports Goods: Gems and jewellery exports, currently valued at $941 million, are projected to double within two to three years, gaining enhanced access to the UK’s $3 billion jewellery market. India’s exports of sports goods, including soccer balls, cricket gear, and rugby balls, along with non-electronic toys, are expected to grow significantly, bolstering India’s competitiveness against major global producers like China and Vietnam.

- Engineering Goods, Auto Components, and Chemicals: India’s engineering exports to the UK are anticipated to surge with the implementation of duty-free access. While India’s global engineering exports amount to $77.79 billion and the UK imports $193.52 billion, only $4.28 billion is currently sourced from India. With tariffs, some as high as 18%, now removed, engineering exports could nearly double to over $7.5 billion by 2029-30. The auto components sector is also well-positioned to benefit from the agreement. In the chemicals and plastics sectors, chemical exports are projected to increase by 30%-40% in the next fiscal year, potentially reaching $650–750 million in 2025–26. Duty-free access for plastics opens up robust opportunities in high-demand segments such as films, sheets, pipes, and kitchenware, enabling India to compete more effectively with global suppliers. India aims to increase plastics exports to $186.97 million over the next five years, representing a projected 15% growth.

- Pharmaceuticals and Medical Devices: The FTA eliminates duties on generic medicines and medical technology equipment originating from India, including vital devices such as ECG and X-ray machines. This provision significantly enhances the competitiveness of Indian generics in the UK, which currently stands as India’s largest pharmaceutical market in Europe.

Services and Professional Mobility

- IT, Financial, Legal, and Professional Services: India’s rapidly expanding services sector, encompassing IT, financial, legal, educational, and professional consultancy services, is set to receive a substantial boost. The agreement actively promotes digital trade, creating new avenues for cross-border technological collaboration and streamlining trade processes to be cheaper, faster, and more efficient. Indian firms and independent professionals will gain access to 36 service sectors without the need for an Economic Needs Test, significantly expanding their operational scope in the UK.

- Skilled Professionals and Social Security Benefits: The agreement streamlines mobility for qualified Indian professionals across various categories, including Contractual Service Suppliers, Business Visitors, Investors, and Intra-Corporate Transferees, along with their family members who have work authorization. Independent professionals such as yoga instructors, musicians, and chefs are also explicitly covered under these provisions. Indian professionals will now have the opportunity to work in as many as 35 UK sectors for up to two years, even without the requirement of establishing a local office. Furthermore, over 1,800 chefs, yoga experts, and musicians will be permitted to work in the UK annually, fostering cultural and professional exchange. A significant achievement for India is the Double Contribution Convention, which exempts 75,000 Indian workers from UK social security payments for up to three years. This exemption applies to both workers and their employers, providing substantial financial benefits to Indian service companies and enhancing their cost competitiveness in the British market. These provisions for professional mobility and social security exemptions are not merely about facilitating individual movement but represent a strategic enhancement of India’s competitive edge in the global services market. By reducing the financial burden of social security contributions and streamlining entry procedures, Indian service providers and professionals become significantly more attractive to UK businesses. This directly supports India’s burgeoning IT and IT-enabled services sector, which heavily relies on the deployment of cross-border talent. This aspect of the FTA positions India as a preferred source for skilled human capital for the UK, deepening the economic interdependence beyond traditional goods trade. It signals a recognition of India’s strength in services and its potential to contribute substantially to the UK’s economy, while simultaneously generating significant remittances and employment opportunities within India.

Key Indian Export Sectors Benefiting from FTA (Goods & Services)

| Sector Category | Key Products/Services | Previous Tariffs (Indicative) | New Tariff/Access | Projected Impact/Growth |

| Goods | ||||

| Textiles & Apparel | Ready-made garments, home textiles, carpets, handicrafts, clothing | Up to 12% | 99% Duty-Free Access | Exponential growth, 5% market share gain in 1-2 years, enhanced competitiveness vs. Bangladesh/Cambodia |

| Leather & Footwear | Leather goods, footwear (e.g., Kolhapuri chappals) | Up to 16% | Duty-Free Access | Exports past $900M, 5% market share gain, benefits MSME hubs |

| Agricultural & Processed Foods | Turmeric, pepper, cardamom, mango pulp, pickles, pulses, fruits, vegetables, cereals, spices, ready-to-eat meals, jackfruit, millets, organic herbs | Up to 70% (processed foods), various for others | Over 95% Duty-Free Access (99.7% for processed foods) | >20% agri-export growth in 3 years, supports $100B agri-exports by 2030, improved margins, competitive advantage vs. EU exporters |

| Marine Products | Shrimp, tuna, fishmeal, feeds | 4.2% – 8.5% | Zero Tariffs | $5.4B export opportunity, significant benefit for coastal states |

| Gems & Jewellery | Jewellery | – | Duty-Free Access | Exports projected to double in 2-3 years (from $941M) |

| Toys & Sports Goods | Soccer balls, cricket gear, rugby balls, non-electronic toys | – | Duty-Free Access | Increased competitiveness vs. China/Vietnam, growth |

| Engineering Goods & Auto Components | Engineering goods, auto components, engines | Up to 18% (engineering) | Duty-Free Access | Engineering exports could nearly double to >$7.5B by 2029-30 |

| Chemicals & Plastics | Organic chemicals, films, sheets, pipes, kitchenware | Up to 8% (chemicals) | Duty-Free Access | Chemical exports +30-40%, plastics exports to $186.97M in 5 years |

| Pharmaceuticals & Medical Devices | Generic medicines, surgical instruments, diagnostic equipment, ECG/X-ray machines | – | Tariff Elimination (generics, medical devices) | Enhanced competitiveness of Indian generics in UK, cost-effective medical devices |

| Services | ||||

| IT, Financial, Legal, Educational, Professional Consultancy | IT services, financial services, legal services, educational services, professional consultancy | – | Significant Boost, access to 36 service sectors without Economic Needs Test | Enhanced cross-border tech collaboration, significant boost to booming services sector |

| Professional Mobility | Engineers, architects, chefs, yoga instructors, musicians, Contractual Service Suppliers, Business Visitors, Investors, Intra-Corporate Transferees | – | Simplified visa processes, liberalized entry, work in 35 UK sectors for 24 months, 75,000 workers exempt from UK social security for 3 years | Enhanced cost competitiveness of Indian talent, substantial financial benefits to Indian service companies |

Benefits for the United Kingdom: Expanding Market Access and Investment Opportunities

The India-UK FTA is structured to deliver substantial advantages for the United Kingdom, primarily through reduced tariffs on its key exports to India, expanded market access for its services industry, and new opportunities in public procurement. The agreement is anticipated to increase UK exports to India by nearly 60% in the long run, translating to an additional £15.7 billion by 2040.

Goods Sectors

- Spirits (Whisky, Gin): Tariffs on British whisky and gin are set for a significant reduction, dropping from the current 150% to 75% immediately upon the agreement’s entry into force, and further to 40% over a ten-year period. This provides UK distillers a considerable competitive advantage in India, which ranks among the world’s largest and most rapidly expanding whisky markets. Projections indicate that UK beverage and tobacco exports could experience an increase of approximately £700 million, representing a remarkable 180% growth. The dramatic reduction in tariffs on spirits, particularly whisky, extends beyond a mere price decrease; it renders premium British brands significantly more affordable and competitive within the Indian market. This is crucial for establishing and strengthening brand presence and capturing market share in a country characterized by a rapidly expanding middle class and increasing disposable income. The phased implementation of tariff cuts over ten years also provides Indian industries with adequate time to adapt to the new competitive landscape. This provision is therefore not solely about boosting export volume but about solidifying the presence of iconic British brands in a key emerging market, potentially leading to increased brand loyalty and sustained long-term revenue streams for UK companies.

- Automotive (Cars, Parts): Tariffs on British cars will see a drastic reduction from over 100% to just 10% under a quota system. This reduction will make British-manufactured vehicles, including luxury brands like Jaguars and Land Rovers (though owned by an Indian company, Tata, these are manufactured in the UK), more affordable for Indian consumers and enhance their market entry into India’s growing vehicle market. UK motor vehicle exports, encompassing both completed vehicles and parts, could increase by £890 million, representing a substantial 310% growth.

- Consumer Goods: The reduction in average tariffs on UK goods entering India from 15% to 3% will make British products such as soft drinks, cosmetics, and medical devices more affordable for Indian consumers. This reciprocal benefit could also lead to a reduction in the cost of everyday goods like clothes, shoes, and food products for UK consumers importing from India.

- Aerospace: The FTA facilitates significant contracts within the aerospace sector, with Airbus and Rolls-Royce securing deals valued at approximately £5 billion to supply aircraft to major Indian carriers, with Rolls-Royce engines powering more than half of the fleet. Aerospace products will also benefit from a reduction in duties, dropping from 11% to 0%.

- Silver: Silver, which represented the UK’s largest export item to India in the last fiscal year with a value of $2.1 billion, will now benefit from zero-duty import. This provision is expected to significantly boost the trade volume of this key commodity within the UK’s export basket.

Services and Investment

- Financial, Environmental, and Construction Services: The FTA guarantees access for the UK’s globally recognized services industry, ensuring fair treatment for sectors such as financial services, environmental services, and construction services when operating in India. This commitment includes a dedicated chapter specifically addressing financial services. Furthermore, commitments on digital trade will promote compatibility of digital systems and facilitate paperless transactions, making cross-border service provision more efficient and cost-effective for UK businesses.

- Clean Energy: The clean energy industry in the UK is set to gain unprecedented access to India’s vast procurement market as India accelerates its transition towards renewable energy sources. The FTA actively supports cooperation and trade in key UK growth sectors, including clean energy, transport, recycling, and the circular economy, aligning with global sustainability goals.

- Public Procurement: India has opened an estimated 40,000 central government contracts above a specified value to UK businesses, granting them local contractor status provided they meet a domestic content threshold of 20% or more. This provision offers UK businesses access to a substantial market comprising 40,000 tenders valued at £38 billion annually. The provisions for UK services, clean energy, and public procurement highlight a strategic diversification of the UK’s export focus beyond traditional goods. By securing access to India’s rapidly growing services market and its massive infrastructure and renewable energy projects, the UK is leveraging its strengths in high-value sectors. This approach aligns with the UK’s post-Brexit strategy of forging new, significant trade partnerships globally, particularly with fast-growing economies. This indicates that the FTA is a critical component of the UK’s broader global trade strategy, aiming to reduce reliance on traditional European markets and tap into the immense growth potential of the Indo-Pacific region. It positions the UK as a key partner in India’s development trajectory, particularly in areas of technological innovation and sustainable growth.

Key UK Export Sectors Benefiting from FTA (Goods & Services)

| Sector Category | Key Products/Services | Previous Tariffs (Indicative) | New Tariff/Access | Projected Impact/Growth |

| Goods | ||||

| Spirits | Whisky, Gin | 150% | 75% immediately, 40% over 10 years | Enhanced competitiveness, £700M (180%) increase in beverage/tobacco exports |

| Automotive | Cars, Auto parts | >100% (cars), 11% (aerospace) | 10% (cars, under quota), 0% (aerospace) | Cars more affordable for Indian consumers, £890M (310%) increase in motor vehicle exports |

| Consumer Goods | Soft drinks, cosmetics, medical devices, salmon, chocolates, biscuits | 15% (average) | Reduced to 3% (average) | More affordable for Indian consumers, potential savings for UK businesses on components |

| Aerospace | Aircraft, engines, parts | 11% | 0% | Major contracts (e.g., Airbus & Rolls-Royce £5B deals) |

| Silver | Silver (UK’s largest export to India) | – | Zero duty import | Enhanced trade volume, significant boost to UK’s export basket |

| Services | ||||

| Financial Services | Banking, finance, investment services | – | Guaranteed fair treatment, equal footing with domestic suppliers, dedicated chapter | Enhanced market access, increased collaboration |

| Environmental Services | Clean energy, transport, recycling, circular economy | – | Guaranteed fair treatment, unprecedented access to India’s procurement market | Supports UK climate goals, cooperation in key growth sectors |

| Construction Services | Construction, infrastructure projects | – | Guaranteed fair treatment | Enhanced market access, new opportunities |

| Public Procurement | Government tenders | – | Access to 40,000 central contracts (worth £38B/year) | New business ventures for UK firms in India |

The India-UK Free Trade Agreement stands as a strategic and comprehensive partnership poised to unlock substantial economic opportunities for both nations. Through the systematic reduction of tariffs across a wide array of goods and the enhancement of market access for services, the FTA is set to significantly increase bilateral trade, stimulate GDP growth, and generate thousands of employment opportunities.

For India, the agreement provides a critical pathway for its labor-intensive sectors, including textiles, agriculture, and marine products, to gain unprecedented duty-free access to the UK market. This is expected to boost exports and foster inclusive growth, with particular benefits for women and MSMEs. The provisions facilitating professional mobility and offering social security exemptions further solidify India’s position as a global hub for skilled services.

For the United Kingdom, the FTA offers expanded market penetration for its iconic goods, such as whisky and automobiles, alongside considerable opportunities for its world-class services industry within India’s rapidly expanding economy and public procurement market. This diversification of trade relationships is an essential component of the UK’s post-Brexit global strategy.The India-UK Free Trade Agreement stands as a strategic and comprehensive partnership poised to unlock substantial economic opportunities for both nations. Through the systematic reduction of tariffs across a wide array of goods and the enhancement of market access for services, the FTA is set to significantly increase bilateral trade, stimulate GDP growth, and generate thousands of employment opportunities.

For India, the agreement provides a critical pathway for its labor-intensive sectors, including textiles, agriculture, and marine products, to gain unprecedented duty-free access to the UK market. This is expected to boost exports and foster inclusive growth, with particular benefits for women and MSMEs. The provisions facilitating professional mobility and offering social security exemptions further solidify India’s position as a global hub for skilled services.

For the United Kingdom, the FTA offers expanded market penetration for its iconic goods, such as whisky and automobiles, alongside considerable opportunities for its world-class services industry within India’s rapidly expanding economy and public procurement market. This diversification of trade relationships is an essential component of the UK’s post-Brexit global strategy.

The forward-looking elements embedded within the agreement, including commitments on digital trade, support for SMEs, and social development, underscore its ambition to transcend the scope of a traditional trade deal. It is designed as a blueprint for a resilient and mutually beneficial economic partnership, aligning with India’s long-term “Viksit Bharat 2047” vision for developed nation status and the UK’s pursuit of new global opportunities. While the full implementation will necessitate legislative approval in the UK and continuous monitoring to ensure the realization of predicted benefits, the foundation has been firmly established for a new era of shared prosperity and deeper strategic cooperation between India and the United Kingdom.

1 thought on “What sectors will benefit the most from this FTA in both India and the UK?”