In a move mirroring recent actions by rival Reliance Jio, Bharti Airtel is pulling the plug on its budget-friendly Rs 249 prepaid plan effective midnight on August 20, 2025. This decision, announced quietly through the company’s website and app, signals a broader industry shift toward higher-value offerings amid rising operational costs and evolving data demands. As telecom giants recalibrate their strategies, millions of cost-conscious subscribers could face steeper recharge bills, potentially reshaping India’s mobile market landscape.

Key Details of Airtel’s Discontinued Rs 249 Plan

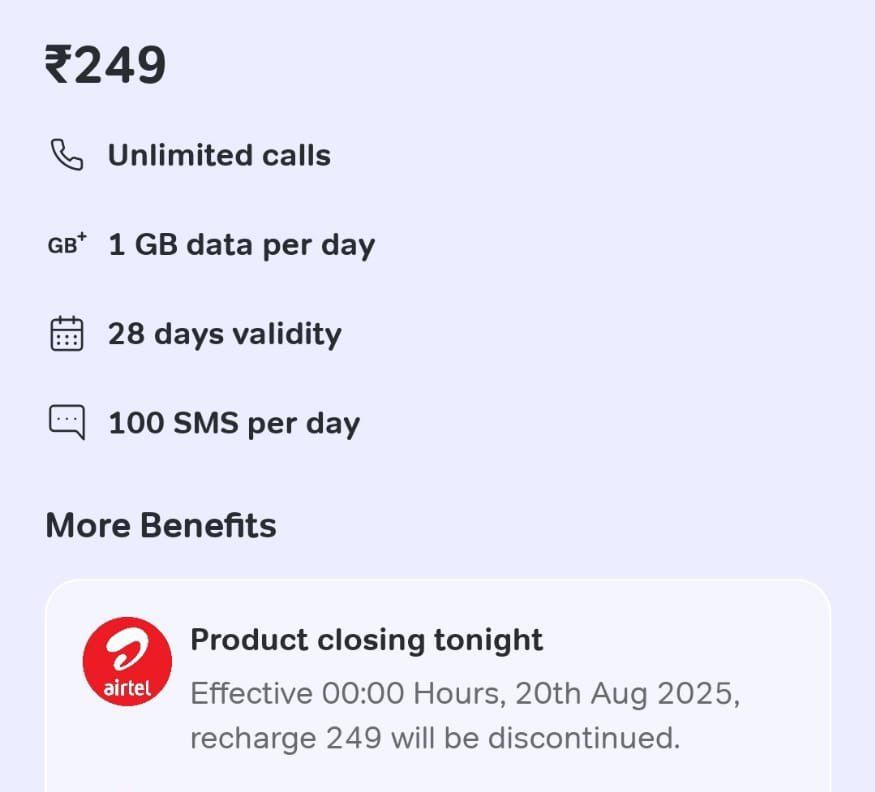

The Rs 249 option, tagged as “Product Closing Tonight” on Airtel’s official platforms, has been a go-to choice for users seeking basic connectivity without breaking the bank. It provided 24 days of service validity, including 1GB of daily data for light browsing, unlimited voice calls across networks, and up to 100 free SMS messages per day. This balanced package appealed particularly to entry-level smartphone owners in rural and semi-urban areas, where affordability often trumps high-speed extras.

Airtel confirmed the removal via its recharge portal, giving users a narrow window—until 11:59 PM on August 19, 2025—to activate it one last time. Post-midnight, the plan will disappear from online listings, apps like the Airtel Thanks platform, and third-party services, forcing customers to explore pricier alternatives.

Echoing Jio’s Strategy: A Pattern Emerges

This isn’t an isolated incident. Just days ago, Reliance Jio discreetly axed its own Rs 249 plan, which offered 28 days of validity with 1GB daily data (previously 1.5GB), unlimited calling, and SMS benefits. Jio’s version was available briefly at physical stores but is now restricted for new subscribers, elevating its entry-level offering to Rs 299 for 1.5GB per day.

Industry observers note the synchronization: Both operators are phasing out 1GB daily data tiers, a segment that once dominated budget recharges. Jio’s move, effective from August 18, 2025, was linked to efforts to boost average revenue per user (ARPU) ahead of potential stock market listings. Airtel appears to be following suit, with insiders predicting its new baseline at Rs 279 for 1.5GB daily data, effectively hiking costs for similar validity.

Expert Views on the Telecom Shake-Up

Telecom analysts interpret these changes as a calculated push toward premiumization. A senior executive cited in Business Standard reports highlights declining interest in 1GB plans since 5G rollout, as users migrate to data-heavy options for streaming and apps. “Consumers are consuming more, so operators are nudging them upward,” the expert explained, forecasting a 10-15% overall tariff increase by year-end.

On platforms like X (formerly Twitter), tech commentators such as Indian Tech Guide and Indian Infra Report warn of ripple effects on low-income groups, who may resort to shorter-validity packs or frequent top-ups. A TelecomTalk analysis echoes this, projecting ARPU gains for both firms in the coming quarter as subscribers shift to plans like Airtel’s Rs 279 or Jio’s Rs 299. YouTube channels like “Telecom Insider” (in August 2025 uploads) discuss how this aligns with global trends, where carriers streamline portfolios to offset 5G infrastructure investments, but at the risk of alienating price-sensitive markets[implied from expert discussions].

Critics, including those on Threads and Hindustan portals, argue the timing—amid economic pressures—could drive users to competitors like BSNL or Vodafone Idea, though the latter have yet to react. One analyst from AMK Resource Info points out that without 1GB options, rural adoption of digital services might slow, given India’s vast feature-phone base.

Impact on Subscribers and Market Dynamics

For everyday users, the fallout is immediate: Budget rechargers must now budget an extra Rs 30-50 monthly for comparable benefits, potentially straining households reliant on sub-Rs 250 plans. Low-data consumers, such as students or elders, lose a tailored entry point, while families could see cumulative costs rise if multiple lines are affected.

Broader market analysis from Economic Times suggests this duo’s dominance—controlling over 70% of subscribers—might trigger a chain reaction, with Vodafone Idea possibly hiking rates to stay competitive. Yet, experts caution against overreach: TRAI regulations on affordability could prompt scrutiny if complaints surge.

As Airtel and Jio prioritize profitability over volume, the era of ultra-cheap data seems to be fading. Subscribers are advised to review alternatives via official apps, but with tonight’s deadline looming, quick action is key for those clinging to the Rs 249 era. This development underscores a maturing telecom sector, where innovation meets the bottom line, but at what cost to accessibility?