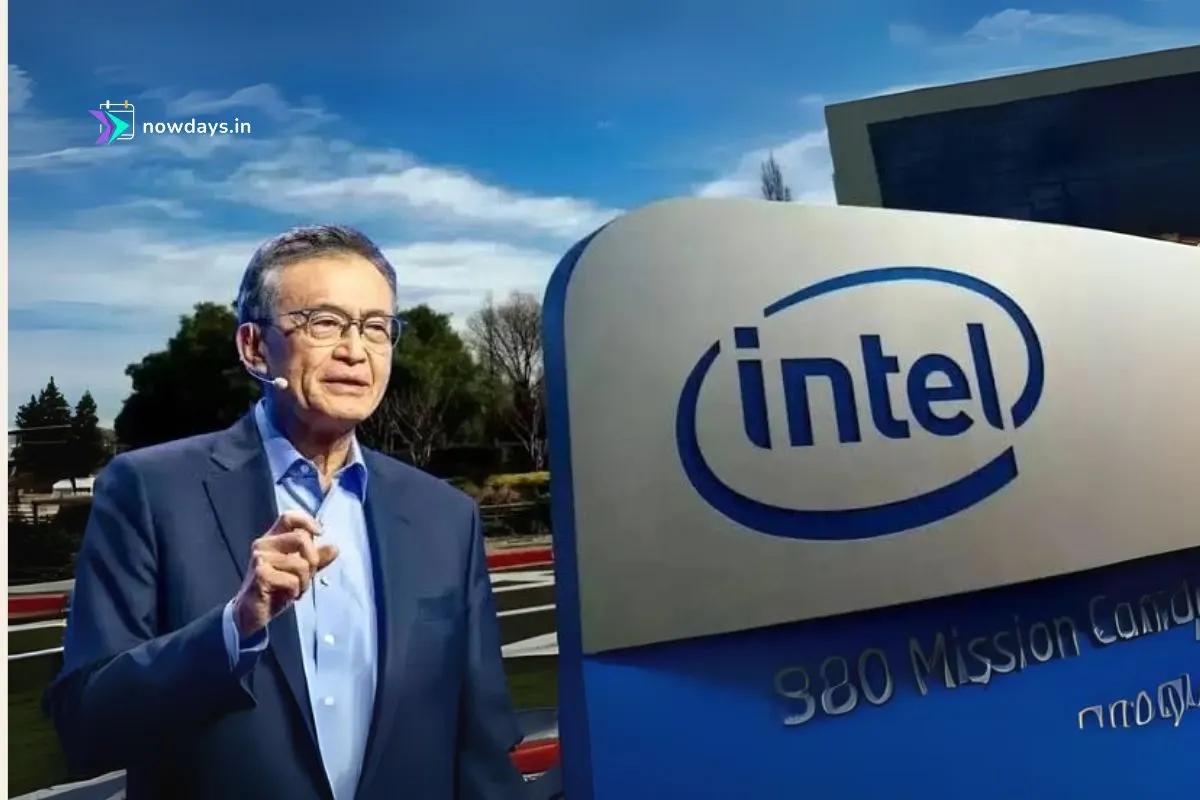

Intel has announced plans to reduce its workforce by approximately 24,000 positions in 2025, representing around a quarter of its core staff.

This move comes under new CEO Lip-Bu Tan’s aggressive restructuring agenda aimed at restoring profitability and competitive edge in the fast-evolving semiconductor sector.

Driving Factors Behind the Job Cuts

Intel’s decision is driven by prolonged financial underperformance and an overexpanded global footprint. The company reported a $2.9 billion loss in Q2 on $12.9 billion in revenue—its sixth straight quarterly deficit, the worst streak in 35 years.

Lip-Bu Tan cited excessive capital spending on fabs and paused projects without matched customer demand. He vowed to eliminate wasteful investments and build only what the market requires.

Impact on Global Operations

- Suspension of the planned “mega-fab” in Germany, which would have hired roughly 3,000 workers, and the assembly/test facility in Poland for about 2,000 roles.

- Consolidation of Costa Rica’s assembly and test operations—affecting over 2,000 employees—into larger sites in Vietnam and Malaysia.

- Further slowing of Intel’s $28 billion Ohio fab construction, now unlikely to finish before 2030, to align capacity with actual demand.

Financial Metrics Snapshot

| Metric | End of 2024 | Target End of 2025 |

|---|---|---|

| Core headcount | 99,500 employees | 75,000 employees |

| Planned reduction | – | ~24,500 jobs (≈25%) |

| Q2 restructuring charges | – | $1.9 billion booked |

| Quarterly loss | – | $2.9 billion |

| Revenue | – | $12.9 billion |

Data compiled from Intel’s Q2 earnings and CEO communications.

Future Strategy Post-Restructuring

- Refocus on high-margin AI and data-center chips to regain market share from Nvidia and AMD.

- Implement strict investment discipline—“no more blank checks”—ensuring each dollar spent has clear economic justification.

- Roll out a return-to-office policy by September to boost collaboration and streamline operations.

- Target $17 billion in operating expense reductions, building on $500 million saved in 2025 and another $1 billion plan for 2026.

What This Means for the Semiconductor Industry

Intel’s large-scale layoffs underscore the challenges facing legacy chipmakers amid the AI boom. As demand shifts rapidly toward specialized accelerators, companies overbuilt for traditional PC and consumer markets are recalibrating. Intel’s belt-tightening serves as a cautionary tale: future capacity expansions must be tightly coupled with verifiable customer commitments.

By cutting headcount and reshaping its global footprint, Intel aims to emerge leaner and more agile. Stakeholders will be watching upcoming product launches and quarterly results closely to gauge whether these “hard but necessary” decisions mark the turning point for the once-dominant chip giant.